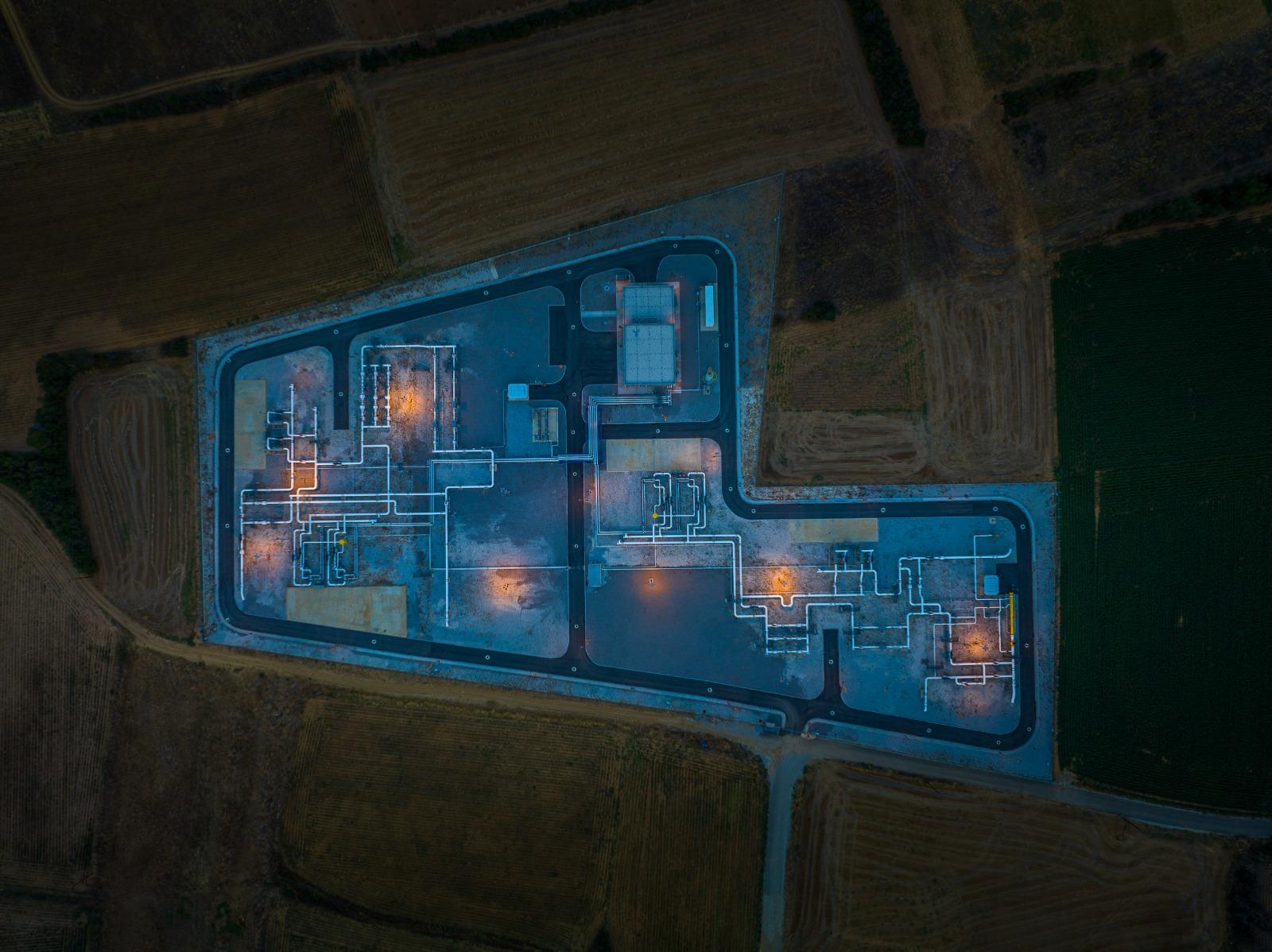

The Greece-Bulgaria Interconnector (IGB) for delivering natural gas from Azerbaijan to Bulgaria was put into commercial operation on October 1, 2022. Currently, its capacity is 3 billion cubic meters per year, but it has the potential to increase throughput to 5 billion. The interconnector connects Bulgaria with the Southern Gas Corridor (SGC) and is part of the Vertical Gas Corridor. This pipeline strengthens energy connectivity and security in the region, providing access to natural gas from new sources.

Report presents an interview with Teodora Georgieva, the executive director of the pipeline company ICGB, who talked about IGB's activities since its commissioning and further plans for the development of this pipeline.

How do you assess the performance of the IGB since its commissioning?

Commercial operations of the IGB interconnector were launched in October 2022 – undoubtedly a challenging time for the region’s energy security. The main goal we had right off the bat was to help Bulgaria reduce its reliance on a single natural gas source, particularly the supplies from Russia and I must say we were able to do just that.

The IGB pipeline became the first route for diversified natural gas supplies to Bulgaria, directly linked to the Southern Gas Corridor through TAP and TANAP. The effect was immediately felt, and optimized prices were achieved shortly for the benefit of business and residential consumers alike.

The pipeline is key for enhanced energy connectivity for the wider region, and it also created new opportunities for both the import and export of natural gas to Bulgarian and Greek markets. It’s role in a wider sense is just as vital – with Russia cutting off gas transit via Ukraine in January 2025, supplies from IGB can be used via the Trans-Balkan gas pipeline to reach Moldova and Ukraine.

We already have experience exporting to both countries in the first months after IGB kicked off and the interconnector’s relevance to support the energy security of these two countries can only grow now.

I must say ICGB was able to create a truly stellar team, and this contributed greatly to the smooth operations of a newly launched pipeline. Marking over a year and a half since we began operations, we’ve had 0 accidents and secured continuous gas flow every single day. Our main goal is to ensure secure, predictable and safe gas transportation for all network users and clients. Since launch, over 2 billion cubic meters have been transported through the IGB pipeline since its launch, reaching more than 40 registered network users.

What are the prospects for increasing IGB's capacity to 5 billion cubic meters of gas per year or more? Can this expansion be implemented in stages?

IGB currently operates at 3 billion cubic meters per year, but you are right - this capacity can in fact expand to 5 bcm/y. We believe this is something that will bring benefits to the regional market in the long run, so ICGB is committed to such an expansion project.

Together with regional TSOs especially under the Vertical Gas Corridor initiative, we launched an incremental capacity process to assess the market demand for increasing IGB’s technical capacity.

The process is ongoing but given the market’s volatility right now not all indications are great. Nevertheless, ICGB will remain dedicated to regularly assessing the demand for additional transportation services and is still committed to the expansion process. We are currently working towards securing funding options for this project.

On July 1, ICGB initiated annual auctions for available capacities on the Greece-Bulgaria interconnector. How long will this auction process last, and has there been interest from companies in booking spare capacities of the gas pipeline? What are the upcoming steps in this auction process?

ICGB initiated annual auctions for its available capacity on the 1st of July 2024, according to ENTSOG’s auction calendar. The available capacity offered by ICGB during those auctions for the next consecutive five gas years remained unsold.

Our team analyzed these results in-depth and believes the current market conditions were decisive in this outcome. A major factor seems to be the delay of the FSRU in Alexandroupolis, as its infrastructure is in such synergy with IGB.

Combined together, the two projects are often seen as a new gateway for natural gas from diversified sources to the SEE region. The market’s inability to predict and plan in advance given the postponed LNG terminal has likely impacted the interest and the willingness of market participants to make long-term capacity commitments.

Another key aspect that remains influential is the altered market juncture and the entry of cheap Russian gas from Turkey. There is enough evidence to conclude that this also affects the competitiveness of alternative liquefied gas from America or other destinations.

ICGB will still carry out its planned monthly auctions so market participants will have the opportunity to plan shorter-term and book capacity on demand.

Which financial institutions are involved in the discussions regarding funding to expand IGB's capacity? As we know, European banks have shown reduced willingness to allocate funds for energy projects in recent years.

Indeed, as I mentioned we’re looking at options to secure funding for the expansion and this is applicable for all TSOs in the Vertical Gas Corridor that plan capacity upgrades. ICGB’s holding discussions with its shareholders on the matter, and we also plan to initiate a market test involving local commercial banks.

IGB’s expansion is a key part of the realization of the Vertical Gas Corridor, and I believe there’s wide consensus in recognizing the initiative’s immense importance for the region’s energy security in the future. Completing all these aligned projects to improve the natural gas transportation infrastructure and overcome the so-called bottlenecks will enable increased gas flow to our countries – an increase from 5 bcm/y to 10 bcm/y.

This is undoubtedly a key strategic decision for a better-connected Europe and even though the European Commission isn’t inclined to supporting financially gas projects right now, we believe this is worth the exception. TSOs in the region are consolidating for a series of meetings with the EC on the matter so we hope this is still an option worth exploring.

Separately, ICGB’s in talks with the United States Agency for International Development for potential fonds under the Agency that would be willing to provide grant funding. We’re looking at other options for US funding as well, and – of course – for opportunities for European funding.

Is the feasibility of transporting hydrogen via the IGB under study? Are there plans to conduct similar studies within the framework of this project in the near future?

By all means, hydrogen is a topic of interest for all entities on the energy market. ICGB will be delegating a detailed analysis on the opportunities to transport hydrogen in the future, but I’d like to point out that to a larger extent our development in that aspect will depend on the market interest.

If the business becomes more hydrogen-ready and provides enough demand, TSOs will be ready to respond with the respective investment projects.

For now, even without additional investments, IGB can transport a small percentage hydrogen mixed with natural gas. We’re looking into the exact amount we can reach without the need to invest in additional infrastructure. This will remain an area of interest in the long run, but for now all efforts are dedicated to the security and quality of day-to-day operations and the expansion project.

https://static.report.az/photo/18fba401-0702-3e82-b655-433ba863b380.jpg

https://static.report.az/photo/18fba401-0702-3e82-b655-433ba863b380.jpg