The global economy is taking a battering not seen in decades, the outcome of severe restrictions on businesses and households by governments desperately trying to contain a pandemic that’s killed almost 17,000 people worldwide.

The first major numbers outlining the damage tell a story of companies seeing demand plunge at a record pace, activity shrinking and confidence dropping. Government leaders, who’ve compared this to fighting a war, have pledged massive stimulus to cushion the blow and protect jobs, as have central banks, but the measures will almost certainly not prevent a deep recession this year.

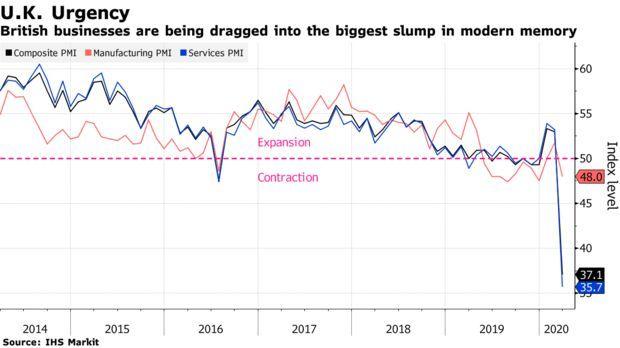

With factories, stores and restaurants shut, aircraft grounded and travel restricted, the monthly Purchasing Managers Indexes from IHS Markit laid out the scale of the challenge. The U.S. PMI, due later on Tuesday, is forecast to show sharp contractions.

The euro-area measure for manufacturing and services dropped to the lowest since the series began in 1998, as did the gauges for the U.K. and Australia. Japan’s composite index fell to the weakest since 2011, while measures for Germany and France also plunged.

“The near term economic outlook is terrible,” said Stephen King, senior economic adviser at HSBC Holdings Plc. “There should be no surprise about these numbers given what is going on and that they confirm what we knew from China earlier.”

The PMI may not even capture the full extent of the downturn because of the way the hit to supply chains is distorting the results. IMF Managing Director Kristalina Georgieva warned Monday that the global economy is facing a slump “at least as bad as during the global financial crisis or worse.”

In U.K., separate figures added to the bleak picture. The Confederation of British Industry said manufacturers’ orders books fell sharply, and companies anticipate a drop in output in the coming months.

Investor concern has sparked a panicked selloff in equity markets. The Stoxx Europe 600 Index has fallen more than 30% in the past month, effectively wiping out almost seven years of gains. The S&P 500 is at the lowest since 2016.

The airline industry is among the worst hit, and companies including Germany’s Deutsche Lufthansa have been forced to ground thousands of planes. Countless jobs are at risk because of closures, while manufacturing has also been disrupted by national lockdowns.

Warnings about the depth of the slump having been coming almost daily.

At the weekend, Morgan Stanley said that U.S. gross domestic product could fall at an annual rate of 30% in the second quarter, driving up unemployment to average 12.8%. Federal Reserve policy maker James Bullard offered an even worse prediction that the jobless rate could rise to 30%.

Bloomberg Economics says the global economy will shrink almost 2% year-on-year in the first half, with the euro-area suffering the worst back to back quarterly contractions in its history. While a pickup is expected later this year, “a lot needs to go right” for that to happen, according to Tom Orlik, BE chief economist.

Just hours before the euro-area PMI, Goldman Sachs Group Inc. said the region’s economy could shrink more than 11% quarter-on-quarter in the three months through June.

Central banks are continuing their firefight, with almost 40 interest-rate cuts last week alone.

The Fed unexpectedly announced more huge measures on Monday, saying it will buy unlimited amounts of Treasury bonds and mortgage-backed securities to keep borrowing costs at rock-bottom levels. Both the Bank of England and the European Central Bank have also announced huge expansions of their asset-purchase programs.

https://static.report.az/photo/bceba292-6c7f-487b-8053-c56cc9d2a7b5.jpg

https://static.report.az/photo/bceba292-6c7f-487b-8053-c56cc9d2a7b5.jpg