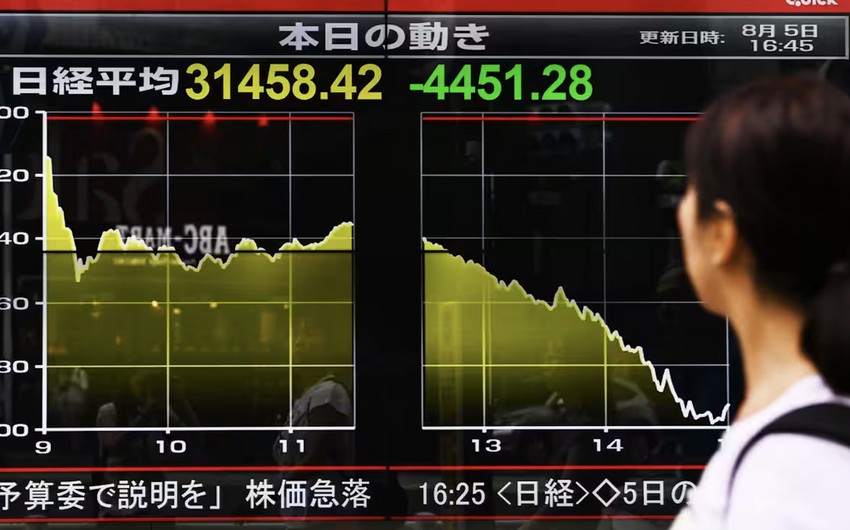

The Japanese stock market demonstrated remarkable resilience on Tuesday, with the Nikkei 225 index surging 9.3% after a devastating 12.4% plunge the previous day.

According to Report, which cites Interfax, leading the charge was Kikkoman, a renowned producer of food products and seasonings, whose shares skyrocketed by nearly 21%. The technology sector also experienced significant gains, with companies such as Tokyo Electron (+14.2%), Screen Holdings Co. (+10.4%), Socionext Inc. (+8.3%), Renesas Electronics Corp. (+17%), SoftBank Group (+9.1%), and Advantest (+13.6%), all posting impressive increases.

Major Japanese corporations, including Toyota Motor (+10%), Sony Group (+8.2%), Fast Retailing (+2.9%), Nintendo (+11.8%), and Mitsubishi UFJ bank (+4.2%), also contributed to the market's recovery.

Mirroring Japan's rebound, the South Korean Kospi index jumped 3.8% after a nearly 9% decline on Monday. Samsung Electronics, one of the world's largest producers of chips and consumer electronics, saw its shares rise by 2.1%, while rival chipmaker SK Hynix experienced a 5.2% increase.

Other notable South Korean companies, such as automaker Hyundai Motor (+5.4%)</i>, airline <i>Korean Air Lines (+1%)</i>, and steelmaker <i>Posco (+5.3%), also contributed to the market's recovery.

While Japan and South Korea enjoyed substantial gains, the Chinese Shanghai Composite index dipped by 0.35%, and the Hong Kong Hang Seng index fell by 0.3%. Notable declines on the Hong Kong Stock Exchange included insurer China Life Insurance (-3.6%), casino operator Sands China (-3.1%), and electric vehicle manufacturer BYD (-2.4%).

As Asian markets continue to navigate the challenges posed by the global economic landscape, investors will closely monitor developments in the region, hoping for sustained stability and growth in the coming days.

https://static.report.az/photo/6a73ae4a-bb7e-38b8-8c56-c58232fac18d.jpg

https://static.report.az/photo/6a73ae4a-bb7e-38b8-8c56-c58232fac18d.jpg