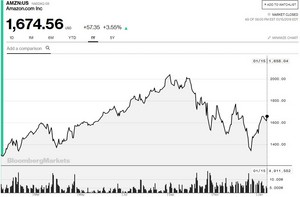

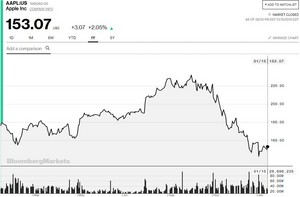

Baku. 16 January. REPORT.AZ/ Several months ago, the world attention was grasped by the market value of Apple and Amazon which exceeded $1 trillion since their shares topped $200 and $2,000 respectively. With current prices at around $150 and $1,700, the corporations have lost nearly 20% in their market value.

Report’s analytical group believes that Apple’s depreciation is caused by litigation with Microsoft Qualcomm. Qualcomm accuses Apple of using its software by violating patent rights. The sides once went into litigation in China, where the court banned the sale of iPhone smartphones.

Qualcomm also sued Apple in Germany where it demanded the ban on iPhone sale in that country, but the claim was met in part.

Qualcomm demands $18-20 for every microchip sold by Apple, while Apple refuses to pay more than $7.5 and has recently stopped any payments to Qualcomm. For this reason, the company sees depreciation of its securities. Nonetheless, the decrease is expected to be followed by a growth with securities likely to reach $250 in value.

Meanwhile, Amazon's depreciation is most probably related to nonpayment of dividends to corporation shareholders though its net profit of $8.9 billion and circulation is $26.7 billion, while cashless turnover reaches $13.36 billion.

Some experts believe that Amazon’s depreciation is a secret plan of Amazon head Jeff Bezos. In this way, he tries to lessen the value of his company and avoid taxes. Official divorce with his spouse is reportedly a part of this plan.

However, Amazon’s depreciation may also be temporary. If corporation shares rise again, the price will likely exceed $2,000 and reach $2,300-$2,400.

https://static.report.az/photo/ca36119b-413c-4431-bbc3-9e48c4576728.jpg

https://static.report.az/photo/ca36119b-413c-4431-bbc3-9e48c4576728.jpg