Demand deposits in Azerbaijan hit 7-year high

- 30 November, 2016

- 13:47

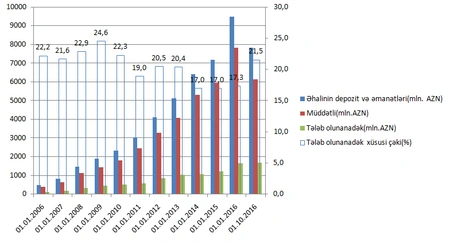

Baku. 30 November. REPORT.AZ/ Demand deposits (termless deposits) make up 21.5% of total banking deposits in Azerbaijan as of October 1, 2016. This is highest indicator for last 7 years.

Report’s expert group revealed that demand deposits constituted 22.3% of all deposits made by population in Azerbaijani banks in 2009.

Increasing share of demand deposits marks loss of trust to banking sector in the long term and possible need for money in short term. Experts believe, this indicator may even rise in 2017. Below diagram reflects structure of banking deposits of population since 2005.

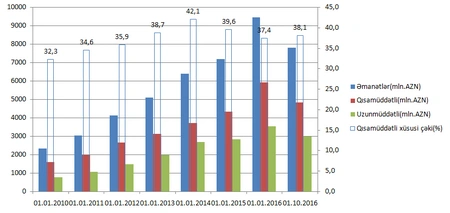

Beside this, experts classified deposits to short- and long-term categories. The analysis reveal that short-term deposits (up to 12 months) make 38.1% of total deposit portfolio. Notably, this indicator was 37.4% at the beginning of this year. The lowest share of short-term deposits was recorded at the end of 2009 with 32.3%. Notably, small share of short-term deposits implies trust of population to banking sector and optimal level of collections. Thus, the population deposits their money for a long term with higher interest rates, whereas the banks can fund long-term investment project. Below diagram shows classification of deposits based on terms.