China’s plans to bolster growth as Covid outbreaks and lockdowns crush activity will see a whopping $5.3 trillion pumped into its economy this year, Report informs referring to Bloomberg.

“The mainstay of policy this year is fiscal spending and government investment, while the central bank is only playing a supportive role so far,” said David Qu, China economist at Bloomberg Economics. “There’s still a lot of space for a stronger fiscal policy, which is more effective in supporting growth now.”

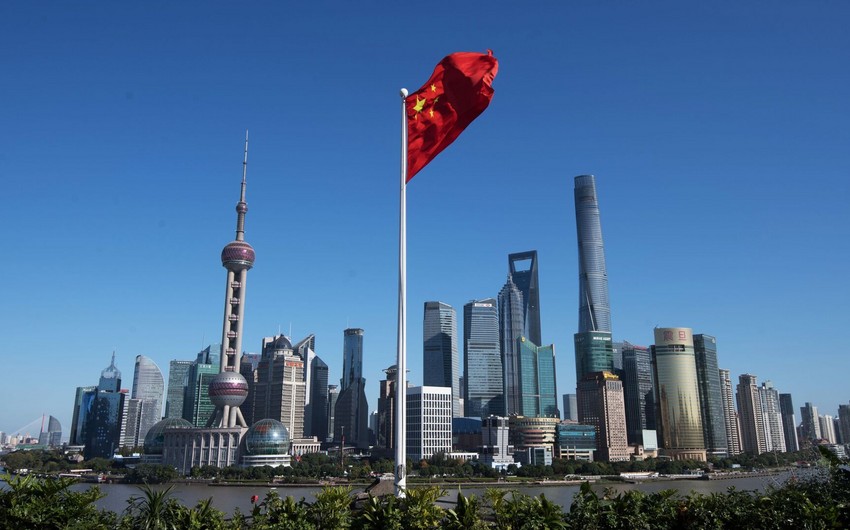

The world’s second-largest economy has come under immense pressure to meet the government’s growth target of about 5.5% for the year. As Shanghai and other cities and regions locked down this spring to contain Covid outbreaks, industrial output and consumer spending sunk to the lowest levels since early 2020.

The bulk of the government support this year comes in the form of fiscal stimulus, including a general budget expenditure target of 26.7 trillion yuan -- nearly 2 trillion yuan more than that of 2021.

The rest of the money will come from tax cuts and rebates, along with a 3.65 trillion yuan quota for local government special bonds, a key source of funding for public projects such as infrastructure.

The PBOC has also been trying to drive down deposit rates, thus giving Chinese lenders an incentive to lower the cost of borrowing and boost slumping demand without direct policy action by the central bank. Banks on May 20 lowered the benchmark lending rate for long-term loans by a record 15 basis points, which would reduce mortgage costs.

The PBOC hasn’t eased much this year, having only cut its policy interest rates once in January by 10 basis points. That compares to two cuts totaling 30 basis points in the first four months of 2020.

The central bank also reduced the reserve requirement ratio -- the amount of money banks have to hold in reserve -- a single time, less than the three cuts made by this point in 2020. The change to the ratio in April, the first reduction since last December, unleashed about 530 billion yuan of long-term liquidity into the economy.

https://static.report.az/photo/49b1dc63-b6f7-35bc-be97-8bc7f42d1a5f.jpg

https://static.report.az/photo/49b1dc63-b6f7-35bc-be97-8bc7f42d1a5f.jpg