Recently, central banks' interest in digital currencies (central bank digital currency, CBDC) has increased dramatically. One after another, the governments of different countries declare the benefits of digital currencies and move from theoretical research to substantive discussion. Commercial companies like Facebook played a big role in this. In the middle of last year, the company announced a Stablecoin (cryptocurrency linked to another asset) Libra. The world realized that transforming a private company (with 2.7 billion users) into a central bank could pose a threat to the global monetary system.

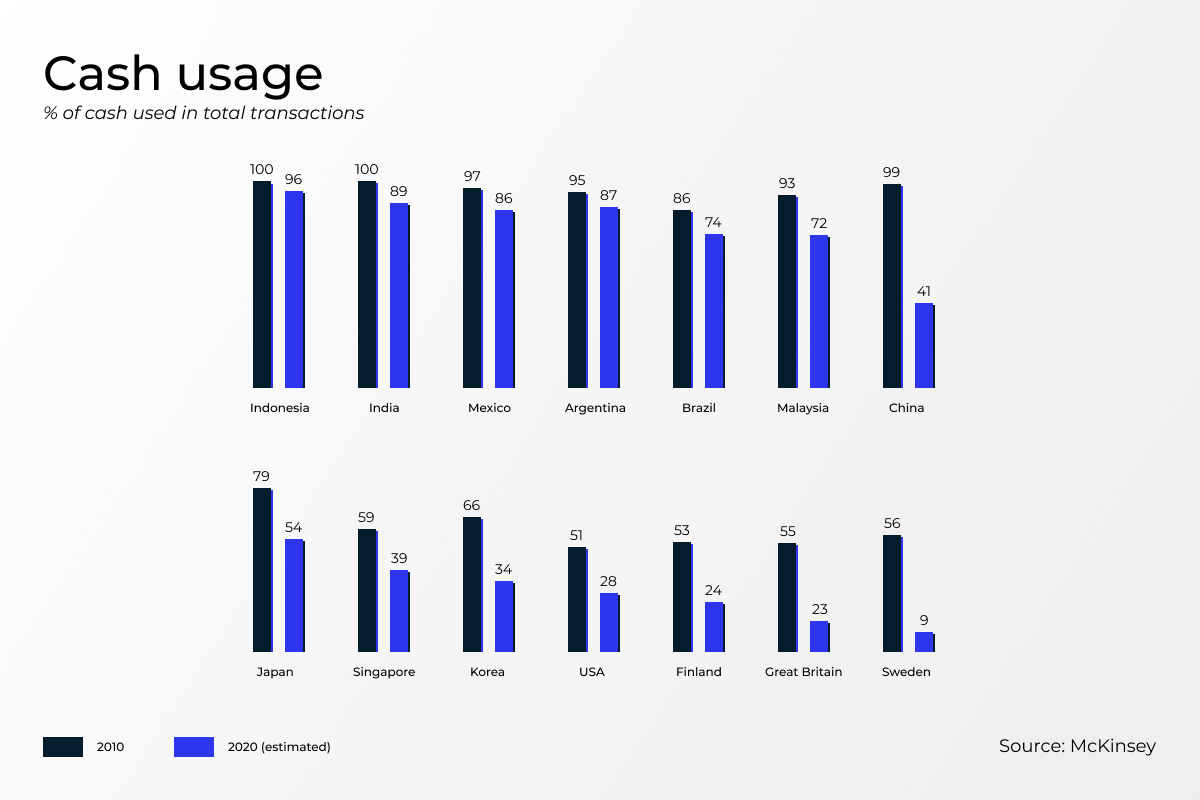

The prospects for creating their digital currency are actively explored by China, the USA, Sweden, South Korea, the UK, Canada, Brazil, Denmark, Norway, Russia, Japan, the European Central Bank, and others. And this increasingly spurs other countries to explore the possibilities of introducing digital currencies. For example, in Japan, research accelerated amid China's digital yuan pilot program.

They considered the release of the Chinese digital currency to be a security threat.

Digital currency, however, even with the most optimistic forecasts, will not replace paper money before 10-15 years.

Coronavirus eased the transition to digital money.

The COVID-19 pandemic has dramatically increased the popularity of contactless and online payments worldwide. First, due to lockdowns, people had to shop online. Secondly, hygiene issues - paper money is often called one of the breeding grounds for viruses. In January-March alone, the volume of non-cash payments around the world grew by 40% year-on-year. Moreover, as expected, this trend will not change after the pandemic. In September, Christine Lagarde, President of the European Central Bank, said that most of those surveyed by the ECB do not plan to return to cash payments, but will even more often use digital payments than they do now.

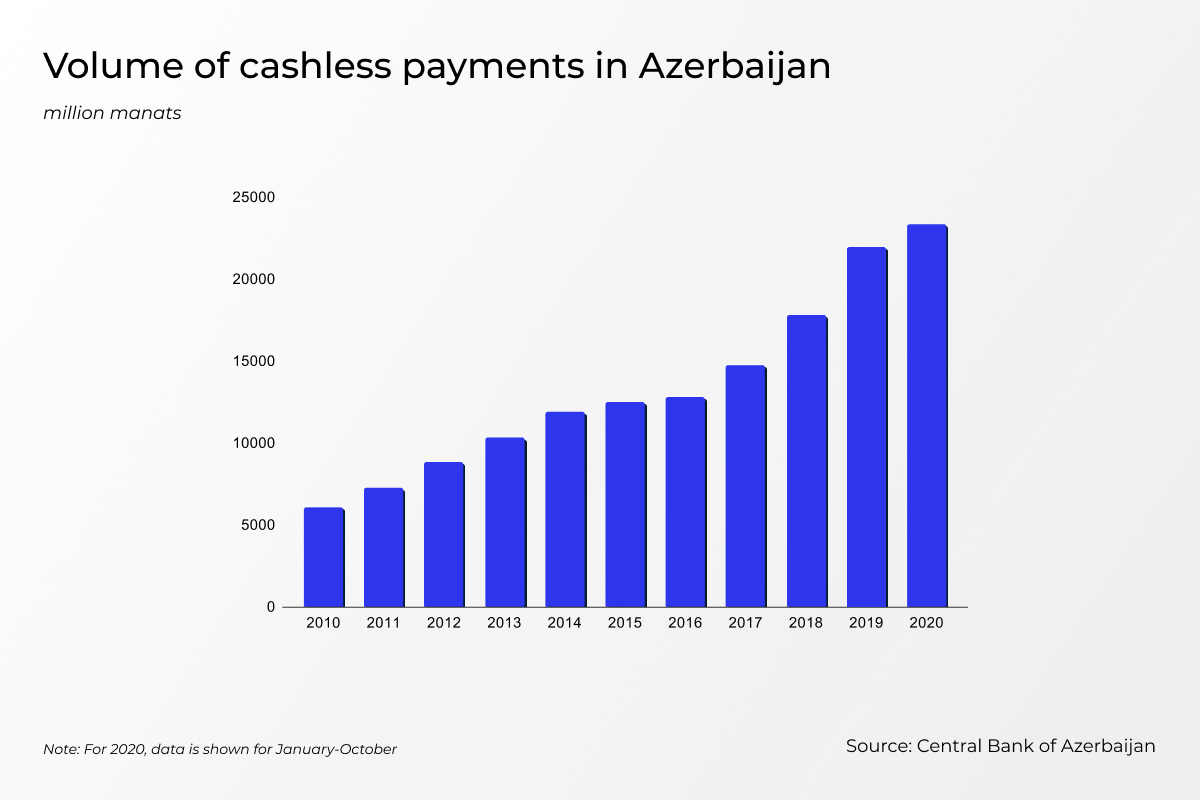

The volume of non-cash transactions is also growing in Azerbaijan. According to the Central Bank of Azerbaijan, in January-October 2020, over 182 million transactions for a total amount of AZN 23.3 billion were carried out in the country. Since the end of 2016, the Central Bank, together with partners, has been implementing the "Cashless Azerbaijan" initiative in the country. It systematically stimulates the use of digital payment methods. This year, the instant payments system was launched in Azerbaijan, significantly speeding and simplifying payment transactions. In the summer, CBA General Director Farid Osmanov, during the launch of another project on non-cash payments in cooperation with Visa, said that an increase in non-cash payments by 10% creates conditions for reducing the shadow economy by 5%.

By the way, one of the main advantages of digital currencies, which is at the same time, the main disadvantage for some, is the control of all financial transactions by the state. In this regard, digital currencies are very different from cryptocurrencies with a decentralized system, like Bitcoin or Ethereum. However, such oversight, on the other hand, can help fight corruption by ensuring full transparency. True, a lot here depends on the model for introducing digital money - based on user accounts or using digital tokens. But one way or another, there will be no complete anonymity of operations.

Benefits and risks

Initially, the risks and benefits in digital currencies go hand in hand—for example, complete transparency and the unwillingness of people to share information with central banks. Or lower costs for non-cash transactions, but the relatively high cost of switching to digital currency.

The first advantage - control of all operations by the state and ensuring transparency - is indicated above. Perhaps this is the most critical factor because it can also scare people away. Exactly what has already happened in Ecuador and Venezuela. Both countries were the first to announce the introduction of digital currencies. Both projects have failed, primarily because the residents of these countries do not trust central banks.

The second advantage is cheapness. That is not just about cutting costs by not having to print money. But this can also include the cost of transporting physical money and associated security costs. The bills also have a lifespan from 1 to 15 years (about 30 years for coins), depending on the frequency of use. Small bills usually wear out faster.

At the same time, it is necessary to consider the financial infrastructure for such a volume of processed transactions. The presence of POS terminals throughout the country, in every store is also a necessity. At present, the number of POS terminals in Azerbaijan is decreasing - over the year, this figure fell from 67.5 thousand to 57 thousand units.

Meanwhile, branches of banks cannot be found in all regions of Azerbaijan. On the other hand, Azerbaijan's Internet penetration rate is almost 80%, which will expand access to finance through mobile payment applications.

The government will have to do enough serious work to explain to the population the benefits and necessity of switching to digital money. Cashless payments stimulate trade and develop the economy. In 2016, Moody's conducted a study in Azerbaijan, which found that thanks to digital payment methods, Azerbaijan's GDP grew by $ 70 million, while consumer spending received an additional 0.06% growth from 2011 to 2015.

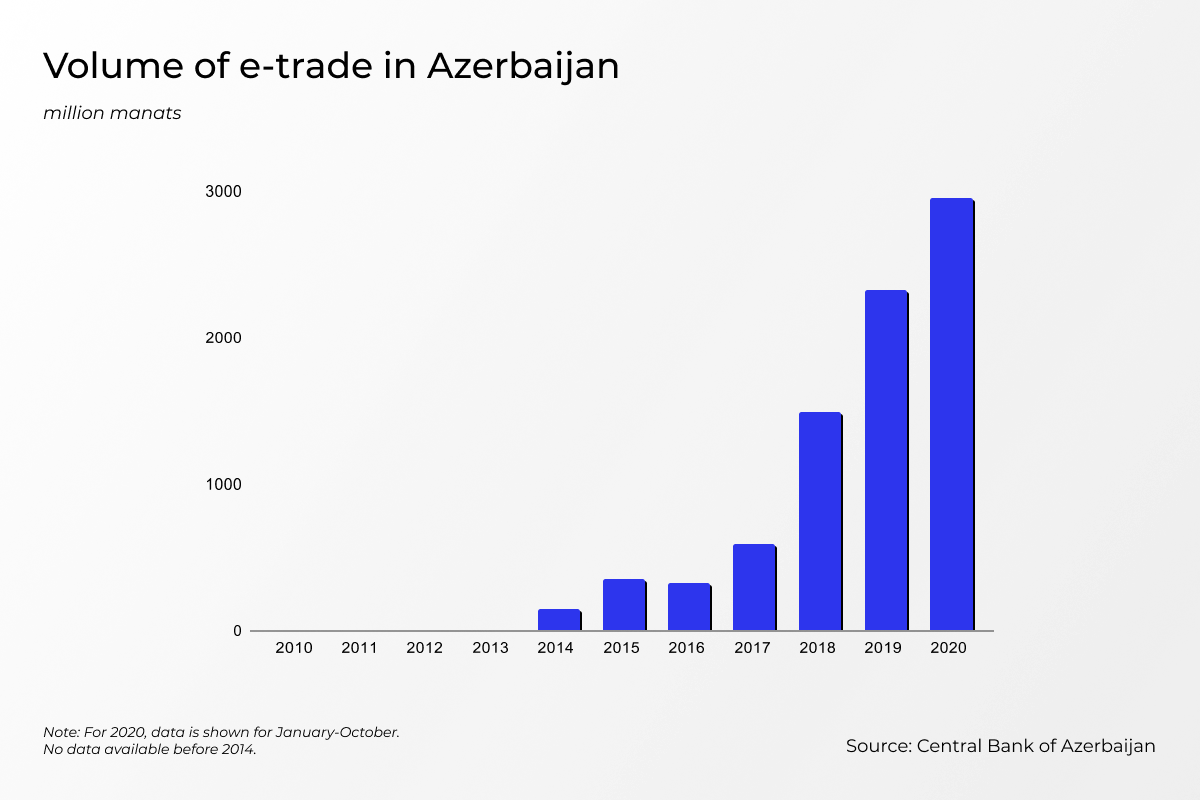

In 2020, amid travel restrictions due to coronavirus, e-commerce turnover in Azerbaijan increased from 34.7 million to 54.78 million transactions. In value terms, the growth was 27%, up to AZN 2.95 billion.

Digital money will also help to make monetary policy more flexible by providing information in real-time, but at the same time will require revision of a large number of regulations and the creation of new regulatory frameworks.

In Azerbaijan, work on the introduction of cashless payments is carried out systematically. The expansion of digital payments is being stimulated, and a regulatory framework is being created to operate fintech companies.

Today Visa and Azercard processing center announced a strategic partnership - this is one of the brightest examples of ongoing work. Within the framework of cooperation, Azerbaijan will develop innovative payment solutions and digital emission. Today it is difficult to say what the digital manat will be like. There are many configurations and possibilities - the central bank can single-handedly control the entire process, or it can connect intermediaries in the form of commercial banks, or completely transfer all the work to them. The infrastructure can operate using either a conventional centralized database or a distributed ledger technology with limited access. Moreover, the manat can only be used domestically or become a cross-border currency. However, the fact that "digital manat" should appear is unambiguous, given the events taking place in the world.

Azad Hasanli, financial analyst

https://static.report.az/photo/54e884b0-3a98-3f5f-b085-d8751cdf5fef.jpg

https://static.report.az/photo/54e884b0-3a98-3f5f-b085-d8751cdf5fef.jpg